Ringing in the New Year often brings fresh resolutions and new beginnings. With 2025 behind us, tax season is right around the corner—and preparation now can make a meaningful difference later. If one of your resolutions is to reduce chaos and stay organized, this 2026 tax checklist will help you prepare, minimize stress and approach the season with confidence.

In our 2026 tax season checklist, you’ll find:

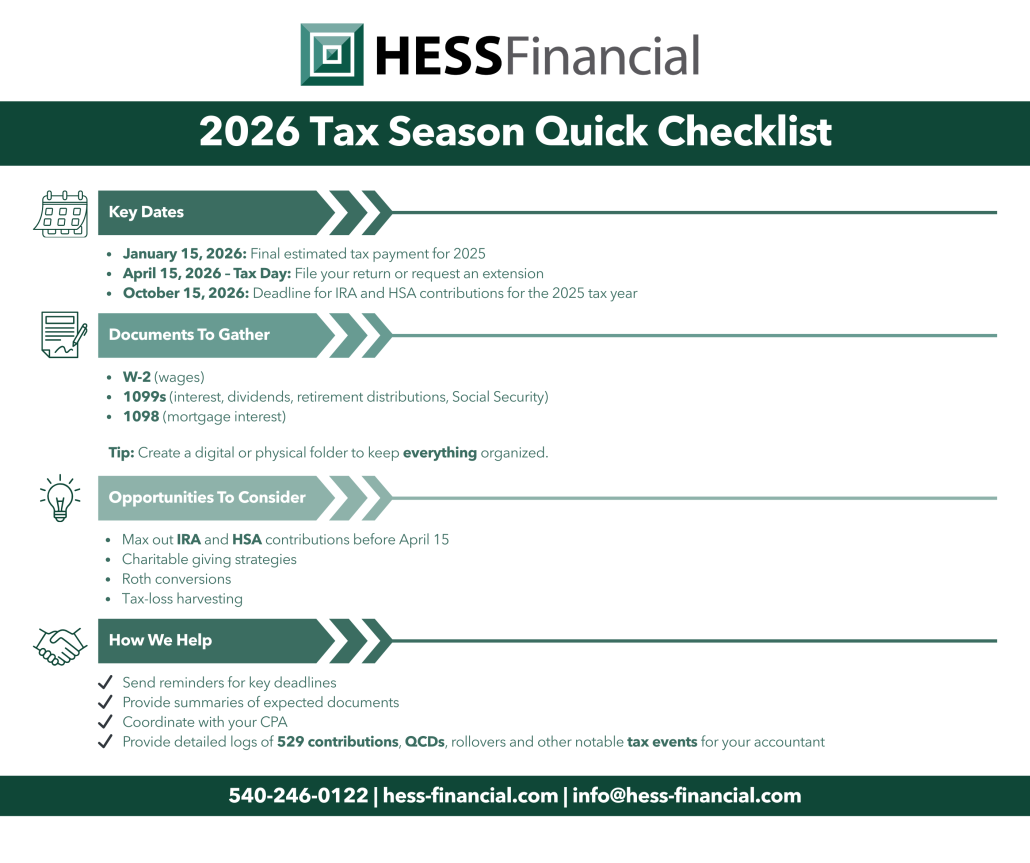

- Key dates to know

- Documents to gather/expect

- Tax planning opportunities to consider

- How our team supports you

Why Preparing for Tax Season Early Can Save You Time, Stress & Money

Tax season can feel overwhelming, especially if it leaves you scrambling to compile everything at the last minute. Early preparation helps you:

- Minimize costly mistakes

- Reduce stress

- Take advantage of opportunities before deadlines pass

Key Tax Season Dates That Can Impact Your Planning

Here are some key dates to be aware of for individuals:

- January 15, 2026: Final estimated tax payment for 2025 (if you pay quarterly).

- April 15, 2026:

- Tax Day! File your return or request an extension.

- Deadline for IRA and HSA contributions for the 2025 tax year.

- First quarter estimated tax payment for 2026.

- June 15 & September 15, 2026: Second and third quarter estimated tax payments.

- October 15, 2026: Extended filing deadline (if you filed for an extension).

The Documents You’ll Need to Prepare for Tax Season

Everyone’s situation looks a little different, but here’s a general list to get you started:

Tip: As your financial planner, we have a good understanding of your planning picture and can help identify which documents may apply to you.

- W-2 for wages from employers

- 1099s for interest, dividends, retirement plan distributions, annuities and Social Security benefits.

- 1098 for mortgage interest

Investment Account Tip:

- Taxable accounts typically generate a 1099

- Retirement accounts often issue a 1099-R if you had distributions or rollovers

Organization Tip: Create a digital folder or hard-copy tax folder to keep everything in one place as documents arrive.

Tax Planning Opportunities to Consider Before & During Tax Season

Although tax season is just a portion of the year, tax planning happens year-round. Our team is trained to identify strategies based on your financial plan and goals to help optimize your tax picture.

Here are some of the opportunities that we frequently discuss:

- Maxing out IRA or HSA contributions before April 15

- Discussing deferrals and any applicable strategies

- Charitable giving strategies (QCDs, appreciated securities, donor-advised funds)

- Considering itemized deductions based on mortgage interest, charitable giving, property taxes, etc.

- Tax-loss harvesting for investments

- Roth conversions

- Coordinating withholdings to minimize the risk of a large refund or tax bill

How We Support You Throughout Tax Season

We know that this is not the highlight (likely) of anyone’s year, so here is what you can expect from us this tax season to help you feel supported:

- Timely reminders for key deadlines

- Detailed logs of 529 contributions, Qualified Charitable Distributions, rollovers and other notable tax events to share with your accountant

- A summary of documents to expect from your investments with us and estimated delivery dates

- Coordination with your CPA to ensure they have everything they need and that we’re aligned on strategy

Ready to Feel More Confident Heading Into Tax Season?

Preparing for tax season doesn’t have to be stressful. Our team helps clients stay organized by identifying key documents, tracking tax-related activity and coordinating with their CPA so nothing falls through the cracks. If you’re feeling overwhelmed or want accountability around preparation and planning, we’d love to help.

Sources: Gather your documents | Internal Revenue Service

Disclaimer: This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.